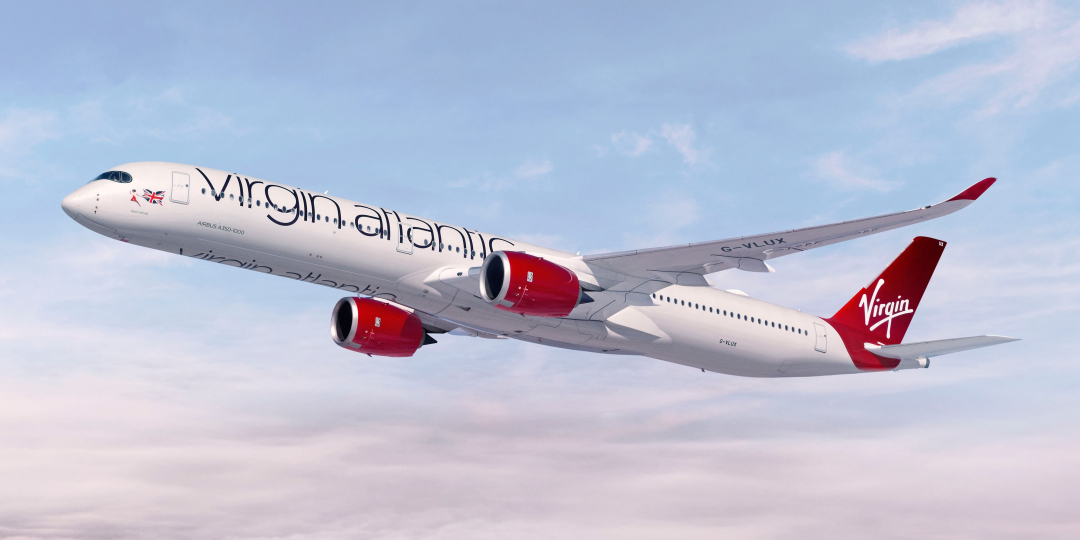

Virgin Atlantic, hard-hit by the collapse in air travel, says despite a £1,2bn rescue package, the airline is running out of time to get the deal approved in the British courts in time to save the carrier before its cash dries up.

Last month, the airline company secured a rescue package from investors, creditors and the Virgin Group. The five-year restructuring process behind the rescue saw it shed 3 500 jobs and announce the closure of its Gatwick Airport operations.

The carrier’s recapitalisation plan is still in a process of legal approval, currently under way in court in London. BBC News reports that Virgin’s lawyers have told the court that the airline's cash flow would drop to "critical levels" by mid-September and it would "run out of money altogether" by the last week of September.

Simultaneously, the airline is engaging in a Chapter 15 process in US courts to protect it from creditors in the US. Chapter 15 is a mechanism that allows US and foreign bankruptcy courts to co-ordinate and collaborate when assets are spread over multiple countries. The airline said: “These ancillary US proceedings have been commenced under provisions that allow US courts to recognise foreign restructuring processes, and have been reported by press on both sides of the Atlantic. In the case of Virgin Atlantic, the process we have asked to be recognised is a solvent restructuring of an English company under Part 26A of the UK Companies Act 2006. To be clear, this is not a Chapter 11 bankruptcy filing. It is a filing which supports the solvent recapitalisation of Virgin Atlantic.”

Liezl Gericke, Virgin’s head Middle East and Africa, told Travel News that Virgin was the first British company to undergo what is a new process of solvent recapitalisation. The process is not in any way a liquidation or bankruptcy process.

Virgin Atlantic is 51% owned by the Virgin Group and 49% by US airline, Delta.