While the international market is seeing increased investment in travel risk management, experts say the South African market is still undergoing education on the importance of holistic risk management and implementing preventative measures.

According to US company Allied Market Research, the global travel risk management services market is projected to reach US$223,62 billion (R4,1 trillion) by 2031, growing at a CAGR of 8,1% from 2022 to 2031.

Risk management companies say businesses in South Africa invested more in travel risk management before the pandemic, with less focus on pre-emptive preparation and more on emergency response. And despite tighter budgets, risk-management specialists have found that risk assessment and management approaches have become more thorough.

In South Africa, duty of care policies mean businesses and organisations are legally responsible for providing robust plans to ensure employee safety, particularly when they are travelling, says Jared Higgins, CEO of Arcfyre Group.

“If you look at the latest UK legislation, the duty of care legal requirements, on a CEO specifically, are quite onerous. If employees are travelling in other countries, the CEO is liable to provide duty of care, in other words, keep them safe. If you look at the duty of care from that angle, it's absolutely imperative that you do proper risk management,” explains Gert Kriel, Director of African Prism.

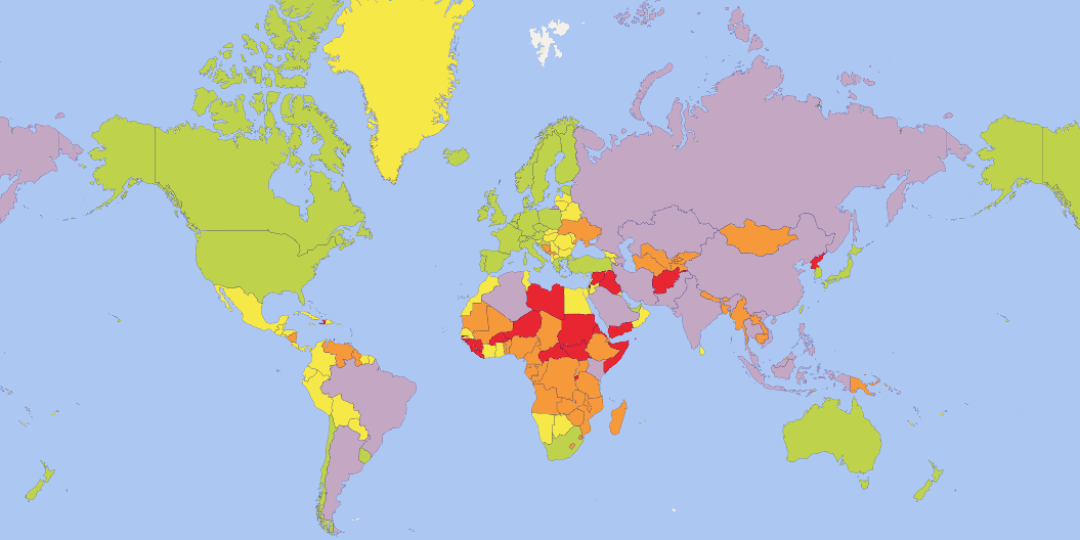

Kriel says this process includes area-specific risk assessments according to a risk matrix – a system which calculates the probability of encountering potential risks based on their prevalence in specific areas – as well as incident management plans.

According to Higgins, businesses can consider travel risk management a success if employees can focus on the business’s objectives during their travels, rather than on their own safety and security.

However, industry professionals report that travel risk management has not always received the attention it is due, particularly in Africa.

Prioritisation

“Typically, what we see is this ebb and flow. There was a great deal of focus around travel security and risk management programmes prior to COVID. Then the pandemic hit, travel stopped, borders closed, and people just weren't going anywhere. I think realistically what we're seeing now is this very slow comeback to what things were like pre-COVID,” Higgins told Travel News.

Post-pandemic, employers are realising the extent of the impact of COVID on budgets. Resources dedicated to travel risk management have shrunk, and many businesses now react to incidents rather than prepare for contingencies.

“Although we are slowly starting to see an increase in spending on travel risk management, the precursor for that is typically when something goes wrong. That is, it takes an accident to happen for people to react,” admits Higgins.

Kriel believes more buyers are now trying to prioritise a more holistic risk management.

Many companies ran into massive challenges when repatriating their employees from around the world during COVID-induced border closures.

The holistic approach includes risk assessment (when standard operating procedures are developed to pre-empt a risk) and incident management protocols (measures to assist travellers who have encountered a risk).

“In the past, there was an untoward heavy focus on the incident management protocols. But most of these incidents could have been avoided with proper risk management,” says Kriel.

According to the experts the most common risks are:

1.Health risks: Including yellow fever, malaria, typhoid, food and water contamination, and Ebola outbreaks. While some of these ailments are not life-threatening, access to adequate healthcare can be challenging, especially in developing countries. Incident management becomes necessary to transport travellers to better-equipped medical facilities.

2.Political instability: Particularly in Central, North and North-West Africa. This can result in violent crime and loss of life. Demonstrations and protests in many developed countries and cities, such as UK, France and the USA, are also resulting in violence and conflict with authorities.

3.Petty crime: Includes pickpocketing and theft, which are increasing with the global cost of living crisis.

4.Road accidents: Standards of driving, vehicle safety and road infrastructure are poor across large parts of Africa, increasing the potential for road traffic accidents (even when using local drivers familiar with conditions). The greatest associated risk is lack of access to medical attention.

5.Societal and cultural norms: Purity cultures can pose a risk to women travellers’ safety, while a lack of acceptance and tolerance for LGBTQIA+ travellers poses the risk of discrimination, and even incarceration and/or deportation.

According to Nick Piper, Director of Signal Risk, there is a disconnection between the perceived likelihood of a risk event and the actual likelihood of that event, because high-profile risk events command greater media exposure.

While Kriel agreed that these high-profile events, such as terrorism, are fewer and further between, he explains that they receive more attention because they can have dire impact and might result in severe injury, trauma or death. Kriel encourages South African businesses to make use of thorough risk assessment, using risk matrices, which more accurately identify the frequency and probability of these events occurring in specific areas, so as to better understand the likelihood of these risks.

Higgins says these incidents receive greater exposure because they are often linked to broader issues including ethnic conflicts, political instability or climate change, and thus have greater impact globally compared with incidents such as common petty crime.

“I think South Africans tend to be a little bit behind the rest of the world. We tend to think of ourselves as more resilient and that we don't need to have these plans in place because we travel to Africa all the time. That’s until something goes wrong and businesses are subject to litigation by staff members because they have been able to prove that the company’s duty of care just didn't exist.”

“Risks are an ever-evolving problem, and they do change from time to time, location to location,” said Higgins.