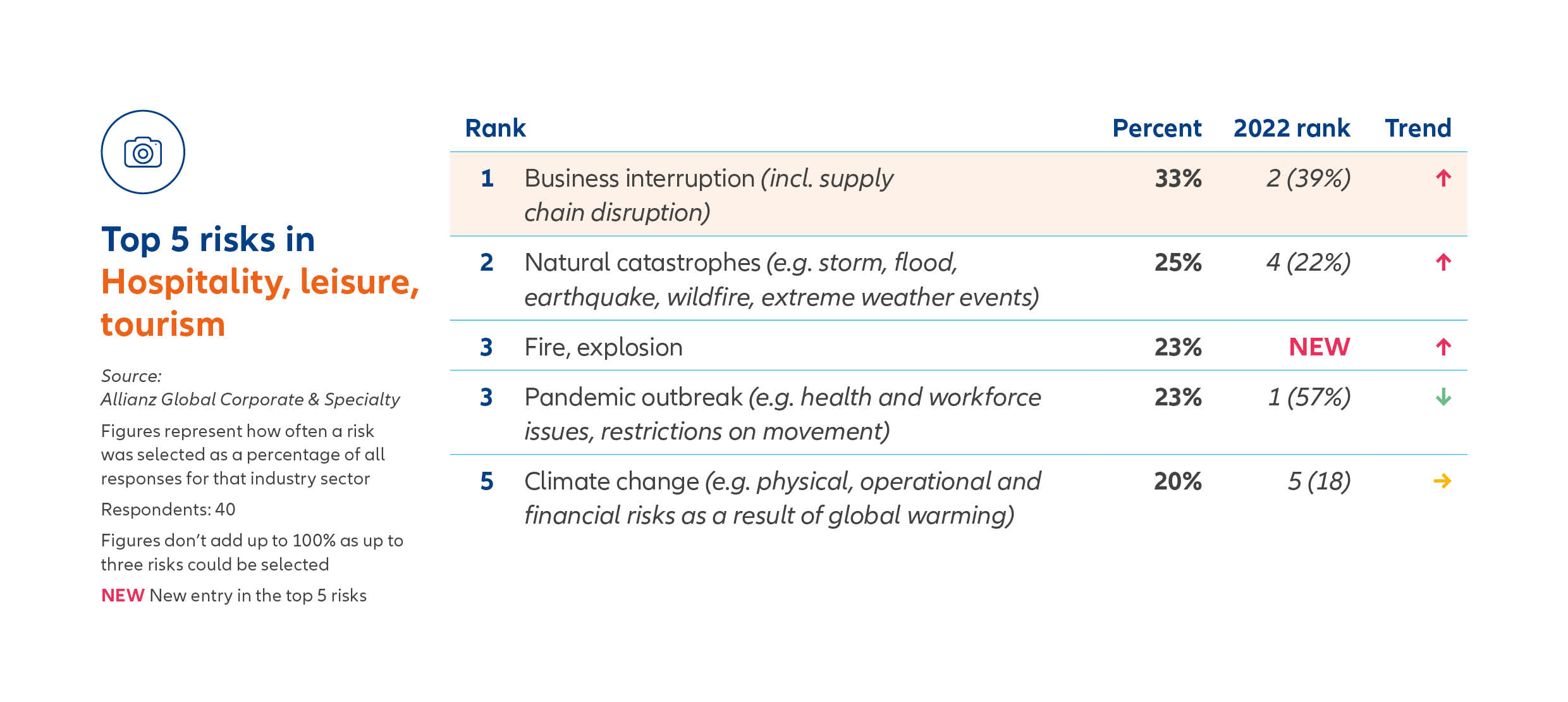

Globally, business interruption is the biggest concern this year for companies in the hospitality, leisure, and tourism industry, according to the Allianz Risk Barometer 2023.

The survey (see methodology in the Editor’s note below) revealed that, despite positive moves to diversify business models and supply chains since the pandemic, businesses continue to experience significant disruption around the world.

COVID-19 came as a massive shock, creating global shortages, delays and higher prices, while the war in Ukraine triggered an energy crisis, turbocharging inflation.

As a consequence of many of the other top risks in the Allianz Risk Barometer, business interruption (BI) is of perennial concern for companies in the hospitality, leisure, and tourism industry, according to Ronald Dodo-Tabaziva, Head of Property at AGCS Property Investments.

“Business interruption will always be a foremost concern, given it is closely linked to profits and revenues and because business models are vulnerable to the geopolitical landscape. Lean supply chains are not always as good value as they appear and there can be a very high dependence on single geopolitical regions such as China, for example.”

The scope of disruptive sources is wide. Cyber incidents are the cause of BI that companies fear most (45% of responses); the second most important cause is the energy crisis (35%), followed by natural catastrophes (31%). The skyrocketing cost of energy has forced some energy-intensive industries to use energy more efficiently, move production to alternative locations or even consider temporary shutdowns. The resulting shortages threaten to cause supply disruption across a number of critical industries.

A possible global recession is another likely source of disruption in 2023, with potential for supplier failure and insolvency, which is a particular concern for companies with single or limited critical suppliers. According to Allianz Trade, global business insolvencies are likely to rise significantly in 2023 by around 19%.

Dodo-Tabaziva highlighted that while the pandemic outbreak plummeted down the list of concerns overall in the report globally (#4 in 2022 to #13 in 2023) – as vaccines have brought an end to lockdowns and restrictions in most major markets – it remains a major concern in the hospitality, leisure, and tourism industry.

"One of the lessons from the pandemic has been the importance of people for business continuity, as well as the broader societal environment in which business operates. The past three years have demonstrated the need to focus on the whole business and not just specific triggers for business interruption."

The South African picture

Natasha Perry, GM of SATIB Insurance Brokers, pointed out that, in South Africa, the top three risks, in noparticular order, were: Critical infrastructure black-outs, cyber incidents and, third, business interruption.

She highlighted, though, that the first two had an indirect impact on business interruption. “So it’s logical to conclude that business interruption as a result of one and two, will be top of mind for tourism and hospitality businesses.”

Analysing the survey results deeper, Perry said both one and two had supply-chain consequences, which again had a knock-on effect on business interruption. For those reasons, insurers have revised their products to either exclude or restrict Contingent Business Interruption cover.

“What we know is that the insurance industry tends to have a knee-jerk reaction to individual (catastrophes, weather and other) events, which can make coverage unaffordable the following year,” said Perry.

According to her, pricing models currently don’t take a long-term view of changing patterns with a through-cycle approach to risks. “We’ve seen insurers’ reactions to the pandemic in 2020, the riots in 2021, the floods in 2022 and more recently the threat of the electricity grid failure.

“The traditional insurance industry has ostensibly not evolved, which has necessitated the need for alternative risk transfer (ART) cover.”

According to Investopedia, ART allows companies to purchase coverage and transfer risk without having to use traditional commercial insurance.

No panacea for risk mitigation

No panacea existed for companies to fully mitigate risk, said Perry. “The risk management environment and the practice of risk mitigation is a complicated and even complex matter for most business owners.

“Regardless of its size, revenue and market share, it takes great skill; a pragmatic and sensible ‘prepare for the worst-case scenario with a crystal ball’ approach of the business’s internal and external risks.”

Perry pointed out that, in focusing on risk mitigation, it was best to start with the basics. “Identify your risks; analyse the risks; evaluate the risks; treat the risks and finally, monitor and report on the risks. Consult with a knowledgeable risk manager, and then speak to your insurance adviser about transferring some of the identified risks, and you'll be off to a good start.”

EDITOR’S NOTE: The Allianz Risk Barometer is an annual business risk ranking compiled by Allianz Group’s corporate insurer Allianz Global Corporate & Speciality (AGCS), together with other Allianz entities, which incorporates the view of 2 712 risk management experts in 94 countries and territories including CEOs, risk managers, brokers, and insurance experts. Respondents were questioned during October and November 2022.

The survey focused on large and small to mid-size companies. Respondents were asked to select the industry about which they were particularly knowledgeable and to name up to three risks they believed to be most important. It is being published for the 12th time. View the full global and country risk rankings