Confidence in Africa’s hospitality industry is growing on the back of a strong 2023 which saw the majority of hotels and suppliers meeting their expectations in terms of improved financial performance, increased occupancies and positive customer feedback.

Presented at the Hotel & Hospitality Africa Expo at the Sandton Convention Centre on June 11, the 2024 African Hospitality Confidence Index – compiled by Moore Global in conjunction with dmg events – surveyed 537 hotels in 30 African countries. More than 50% of the surveyed respondents were based in South Africa.

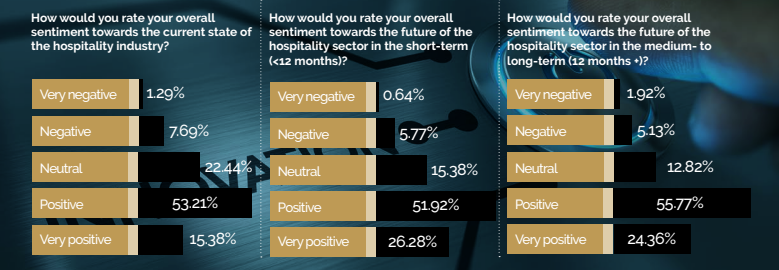

Almost two-thirds of respondents (65%) indicated that their businesses had now recovered from global pandemic disruptions within their expected timeframes, and 69% indicated that the recovery had met their expectations in terms of improved financial performance, increased occupancies and positive customer feedback. Confidence in the future is healthy, with 80% of businesses voicing positivity about medium- and long-term prospects.

“Global key performance indicator data tells a remarkable story of recovery and resilience and reveals an agile and ambitious sector that is no longer looking back, but confidently marching ahead. Data for 2023 shows that on key measures, including RevPAR (revenue per available room), ADR (average daily rate) and occupancy, the industry has defied expectations,” said Marton Takacs, Global Sector Leader: Hotel and Leisure for Moore Global.

Global key performance indicators collated for the latest Moore Hotels’ quarterly report reveal that RevPAR surged in H1 2023 to $110,70 (R2037), eclipsing the 2019 pre-pandemic figure of $105,30 (R1 938). Meanwhile, ADR jumped to $160,60 (R2 956), surpassing the 2019 figure of $144,90 (R2 667).

“Our survey shows that the confidence and dramatically improved operational performance we have seen in global hotel industry data, is echoed in Africa. Sustained growth in tourism and business travel is lifting the entire sector, while hotels are also increasingly efficient at optimising revenue,” Takacs said.

Strong demand, together with Africa’s abundance of spectacular destinations, have also sparked a rush of new investment from leading hotel brands such as Marriott, Radisson, Hilton and Accor.

“Africa’s hotel development pipeline currently stands at 482 hotels (84 427 rooms), including new builds and rebranding as independent operators forge ties with major international groups. Change of this magnitude will inevitably sharpen competition but it also presents unparalleled opportunities for new deals and partnerships at all ends of the market for the owners of hotels, bars and restaurants as well as their suppliers,” said Takacs.

Bleisure ‘the space to watch’

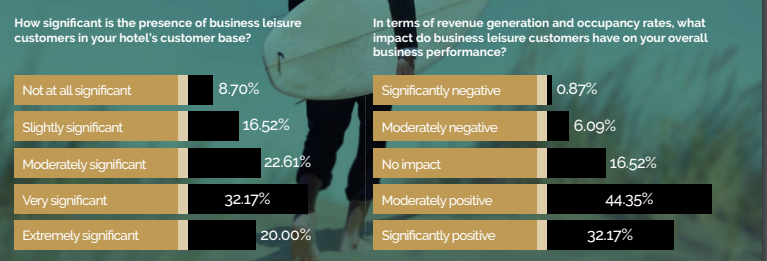

Confidence has been buoyed by the sustained surge in bleisure travel, with 92% of surveyed businesses reporting that this segment holds a significance presence in their hotels. An additional 76% of respondents said bleisure travellers positively impacted revenue generation and occupancies.

Bleisure travel is set to become an even bigger phenomenon in the next decade. Its global value is expected to more than double from 2022 levels to $731,4 billion (R13,4 trillion) globally by 2032, a compound annual growth rate of 8,9%, driving an increase in investment channelled towards meeting the needs of the segment.

“Bleisure travellers may have greater or different demands than conventional travellers – for example, they may require accommodation that can function equally well as a workspace, romantic retreat or family space. This may necessitate additional investment in order to be a destination of choice in a competitive market in which bleisure customers may rate access to a spa or a tour guide as highly as having a comfortable desk and fast WiFi,” the index highlighted.

“Bucket-list trips of a lifetime are still a prominent feature of the African market which offers a wealth of spectacular tourist destinations and leisure experiences. However, bleisure travel is the segment to watch as it is predicted to become an increasingly important revenue generator in the future.”

Hotels no longer resistant to tech

Most businesses are deploying sophisticated strategies to optimise revenue and maximise occupancy, leaning towards dynamic pricing and targeted segment-specific offerings, along with the harnessing of new tech.

Takacs said the African hotel and hospitality industry had shown unprecedented eagerness to adopt new technologies with potential to transform hotel products and raise the bar for guest experiences.

“The industry has historically been slow to adopt new technology, but through our research and work with major international hotel brands and independent national businesses, we see clear evidence that this is no longer the case. The hotels sector is committed to participating fully in the next technological revolution and Africa is keen to play its part,” said Takacs.

The index found that almost a quarter of African hotel and hospitality businesses now use AI in some capacity. This ranges from large hotel chains allocating millions of dollars towards trialling applications through almost all aspects of operations, to smaller operators utilising more modest methods.

“Early deployment uses are the tip of the technology iceberg. AI has the potential to be applied in numerous ways from customer insight to chatbots providing 24/7 guest information; revenue management; security; training; and energy and resource management. AI can also help alleviate skills shortages by freeing employees from repetitive tasks to perform more value-add roles,” Takacs pointed out.

Global AI spend in the hospitality market is expected to mushroom from a value of $90m (R1,65 bn) in 2022 to $8,1bn (R149 billion) in 2033, growing at a CAGR of 60%. However, cost and resource allocation, along with system integration, data privacy and security, and quality and availability of data remain challenges in the African hospitality context.

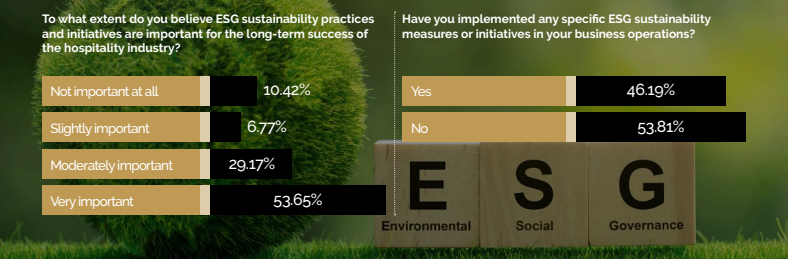

Low awareness of ESG frameworks

While a large majority (89%) of the surveyed businesses acknowledge that environmental, social and governance (ESG) initiatives are important for the long-term success of the industry, implementation has been slow and patchy, with fewer than half (46%) currently having these initiatives in place.

The index identified the chief stumbling block as a limited knowledge of the main international frameworks – such as the UN Sustainable Development Goals – that can be leant on to inform ESG strategy, with 51% of businesses currently unaware of these frameworks. However, those that have effectively implemented ESG measures recognise the business benefits, with 57% reporting a positive impact on customer satisfaction and loyalty.

“Businesses are under pressure to become more accountable and transparent on ESG and sustainability issues, from increasingly environmentally and socially conscious customers and employees, to business partners, investors and legislators,” the index highlighted.

Other identified challenges for the industry as a whole include accessing finance and the cost of servicing debt, along with high interest rates, persistent energy costs and supply and skills shortages.

“Overall, however, the sector looks set on an upward trajectory, with leaders ready to seize new opportunities whilst being alert to potential threats,” the index stated.